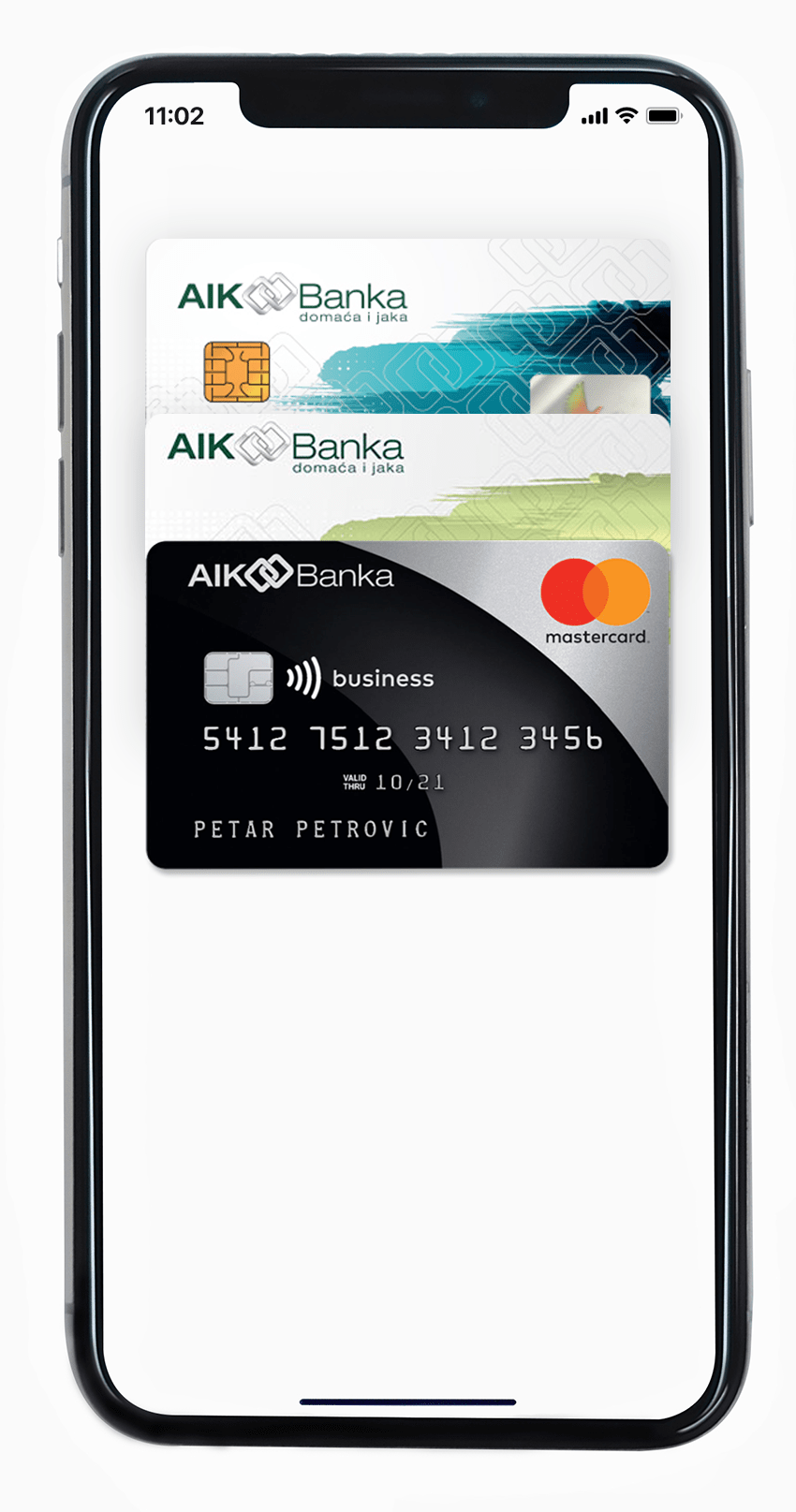

Business Mastercard

Your money’s at your disposal 365 days a year, 24 hours a day, in the country and abroad

The business card for legal entities and entrepreneurs is connected to the dinar account and allows you to

Make payments and withdraw cash in the country and abroad at a large number of POS terminals and ATMs

Keep precise records and control of your employees’ spendings. You may have an add-on card issued for your employees you wish to authorise under the cards. But you can also define a monthly spending limit for the add-on card.

Make payments and withdraw cash in the country and abroad at a large number of POS terminals and ATMs

Effect online transactions with maximum security. With the 3D Secure service, we provide additional security for online card transactions

Make contactless payments, without having to enter your PIN for amounts of up to RSD 4,000 at all points of sale in the country which bear the MasterCard logo

Major advantages of online stores compared to traditional purchases

Safe online shopping with MasterCard cards

If you want to make a card payment at online stores with the MasterCard Secure Code indication, the client is able to make an online payment with the help of a one-time-password, which is an advanced method of security. The internet transaction password is sent in a text message to the mobile phone number already registered for the Card Alert SMS service (notification of authorisation). Update your mobile phone number to which you’ll receive text messages with a one-time password for the execution of online transaction.

SMS notification service

The SMS notification service is the service of providing information about executed transactions. It adds higher security when you use your cards. You’ll be sent an SMS message every time a card transaction is executed.

It can be used at points of sale and ATMs worldwide, which show the MasterCard logo. They’re safer than carrying cash. They can be used to pay for goods and services (expenses, business travel expenses, etc.), to withdraw cash in the country and abroad and also for online payments (hotel booking, buying plane tickets, etc.)

Fixed interest rate

The cardholder chooses his/her on model of repayment – charge or revolving

Charge option

The cardholder may the full amount of spending during the current month until 15th of the following month. If the full amount is paid, no interest will be accrued.

Revolving option

If the cardholder doesn’t pay the full amount of spending, then repayments are made as percentage of debt - 10%, 25% i 100%, minimum RSD 10,000*